what is suta tax rate

52 rows The tax rates are updated periodically and might increase for businesses in certain industries. What is the current SUTA rate for 2019.

What Is The Federal Unemployment Tax Rate In 2020

Your state will assign you a rate within this range.

. This percentage is applied to taxable wages paid to determine the amount of employer contributions due. It is a payroll tax that goes towards the state unemployment fund. For 2022 the minimum overall tax rate is 3 and the maximum overall tax rate is 73.

We notify employers of their new rate each December. Texas law sets an employers tax rate at their NAICS industry average or 27 percent whichever. State Unemployment Tax Act SUTA Indiana Code 22 Article 4.

You can view your tax rate by logging in to the Departments Reemployment Tax file and pay website. The minimum and maximum tax rates for wages paid in 2022 are as follows based on annual wages up to 7000 per employee. Payroll less than 500000.

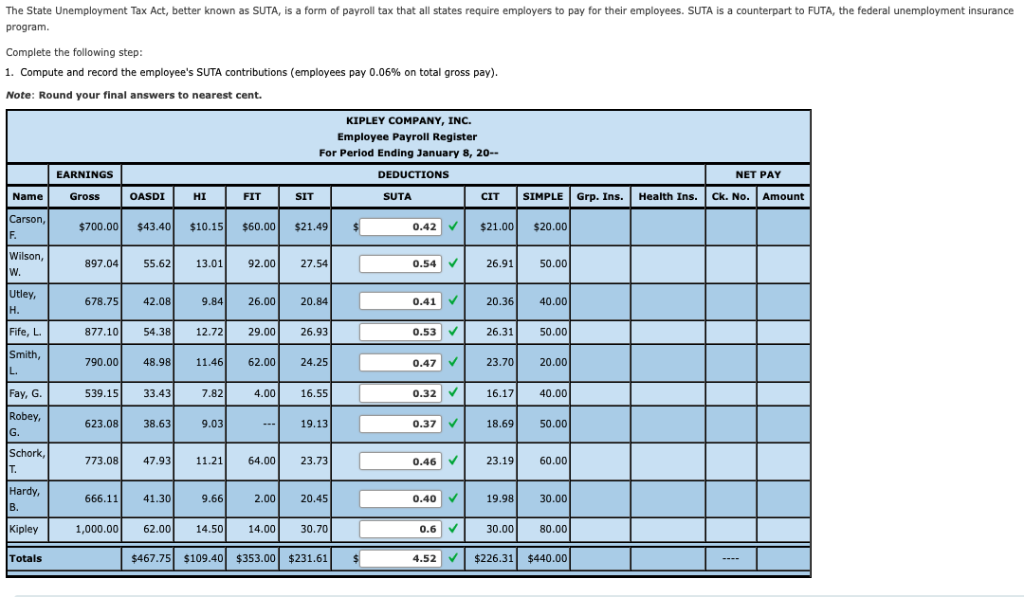

Employees are exempt from FUTA so they do not pay this tax. Also employers should be aware of certain occasions that require them to pay FUTA and SUTA. 52 rows An employers SUTA rate is often referred to as a contribution rate.

The tax does not apply to earnings over 7000. In 2019 the taxable wage base for employees in Texas is 9000 and the tax rates range from 36 to 636. The reserve ratio is the balance in an employers UI account premiums paid less benefits paid for all years liable divided by their average taxable payroll for the three most recent years.

Lets say your business is in New York where the lowest SUTA tax rate for 2021 was 2025 and the highest was 9825 and youre assigned a. 0010 10 or 700 per employee. This contribution rate notice serves to notify employers of their.

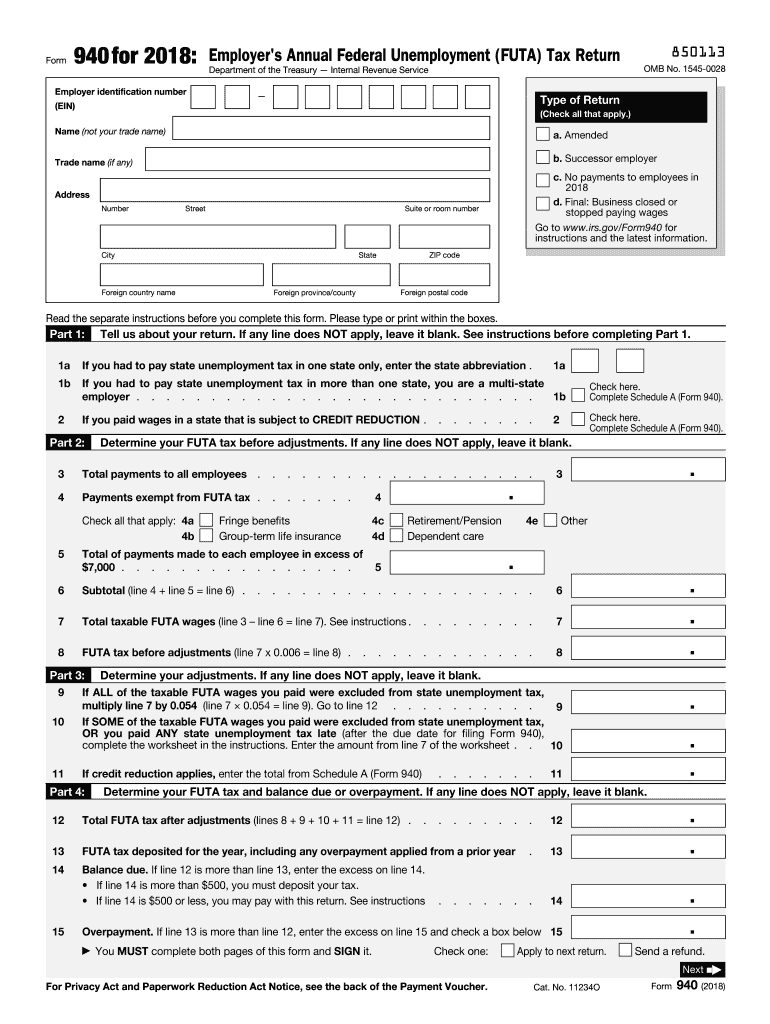

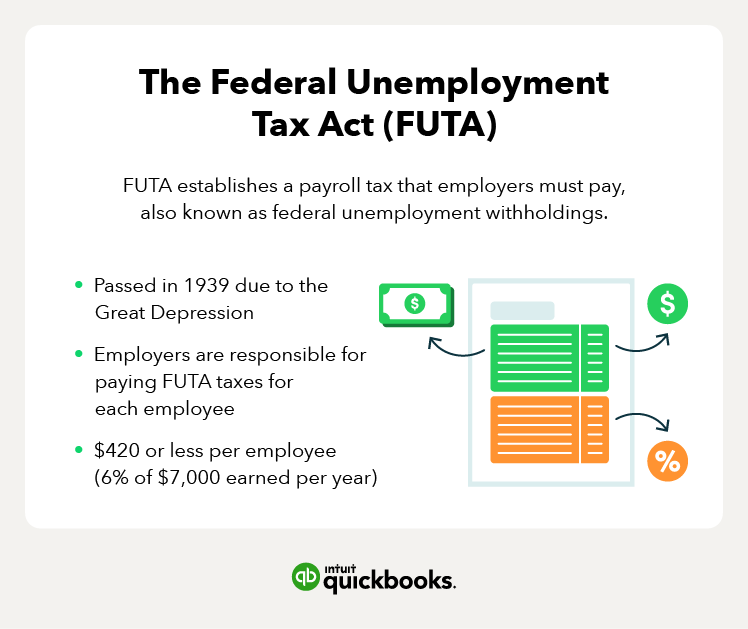

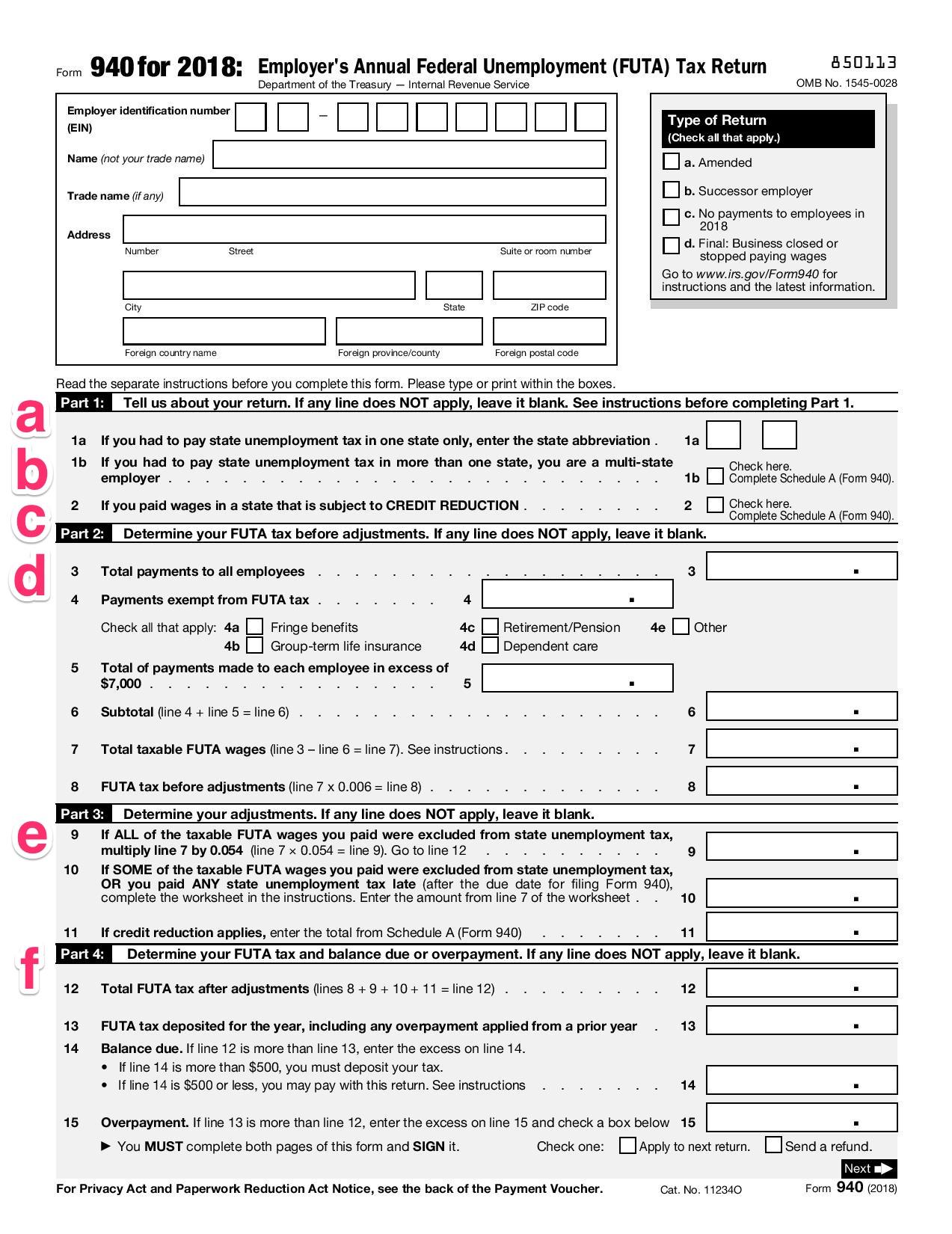

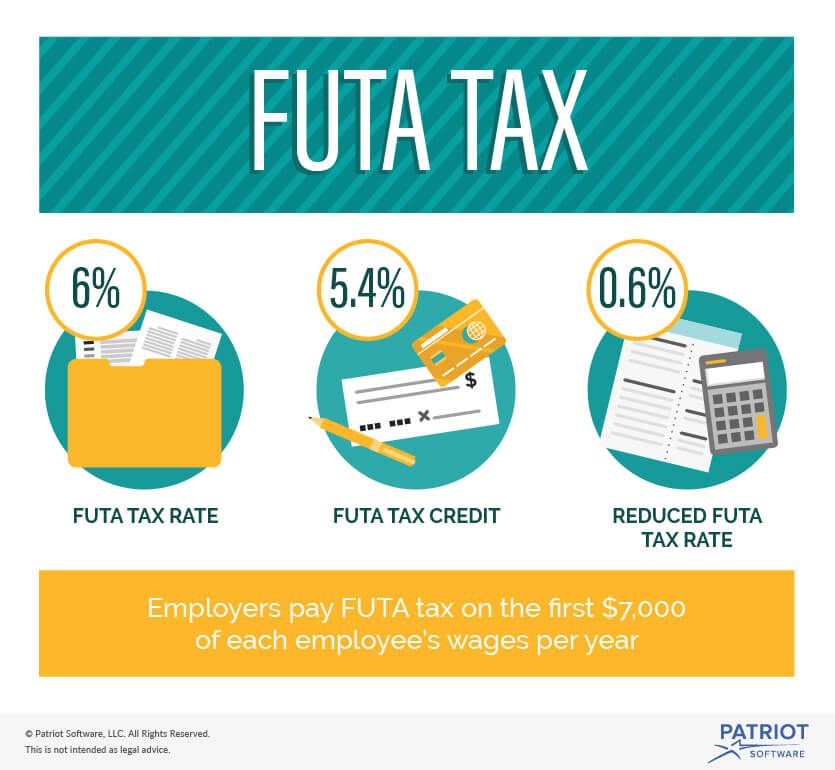

Taxable wage base. The Federal Unemployment Tax Act FUTA is a federal payroll tax that employers pay on employee wages. Equal Opportunity is the Law.

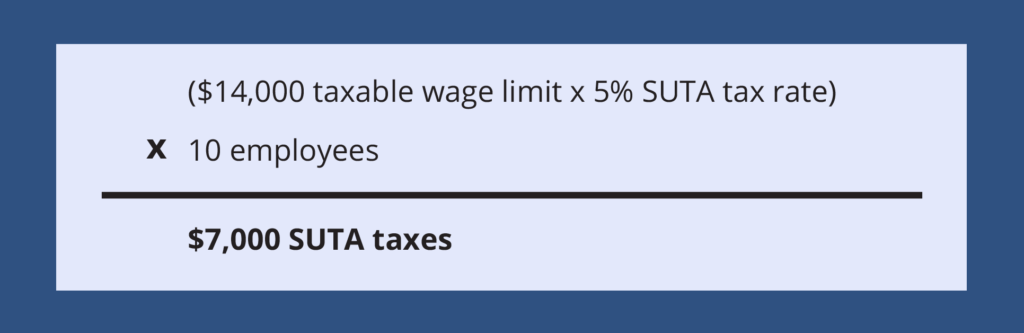

States that raised unemployment tax rates for 2022 and their new ranges include. Please note that tax rates are applicable to the first 14000 each employee earns. Once you know your assigned tax rate youll be able to calculate the amount of SUTA tax youll need to pay for each employee.

Employers who have not paid all contributions for the fiscal year ending June 30th may be assessed a delinquent payment surcharge of 10 which is in addition to the overall tax rate. The contribution rate. A typical SUTA rate ranges from 2-4.

The FUTA tax rate is 6 on the first 7000 of an employees earnings. New employers pay 34 percent 034 for a period of two to three years. The 2022 wage base is 7700.

The 2022 payroll tax schedule is a modest shift down from the 2021 tax schedule with an average rate of 197 percent on the first 47700 paid to each employee. Generally states have a range of unemployment tax rates for established employers. Click here for an historical rate chart.

The employer Premium Rate Chart is then used. The State Unemployment Tax Act known as SUTA is a payroll tax employers are required to pay on behalf of their employees to their state unemployment fund. The maximum FUTA tax an employer is required to pay is 420.

0540 54 or 378 per employee. Employer UI tax rate notices are available online for the following rate years. 2022 PDF 2021 PDF 2020 PDF.

For experience-rated employers those with three or more years of experience the contribution rate is based on a ratio called the benefit ratio which is determined in such a way that the greater the unemployment caused by the employer the higher the rate. The UI rate schedule and amount of taxable wages are determined annually. La Igualdad De Oportunidad Es La Ley Equal Opportunity EmployerProgram Auxiliary aids and services are available upon request to.

A Contribution Rate Notice Form UC-657 is mailed to employers at the end of each calendar year and shows the contribution rate effective for the coming calendar year. The tax class assignment in the notice should be used for the full calendar year. Although tax rates for each tax class are lower or the same as their 2021 levels individual businesses may still move between classes based on their unemployment claim activity.

Payroll greater than 500000. Unlike Social Security and Medicare employees dont share this tax liability with their employers. To see the tax rate schedule ratio rate table and the FUTA creditable factors for ratio-rated employers select the year.

Tax-rated employers pay a percentage on the first 7000 in wages paid to each employee in a calendar year. State Unemployment Tax Authority. The reserve ratio is calculated annually as a measure of the employers potential liability for benefits.

For example the SUTA tax rates in Texas range from 036 636 in 2019. Louisiana Unemployment Insurance Tax Rates. Most states send employers a new SUTA tax rate each year.

Glencoe Mcgraw Hill Payroll Taxes Deposits And Reports Ppt Download

What Is Futa Basics And Examples Of Futa In 2022 Quickbooks

What Is Futa An Employer S Guide To Unemployment Tax Bench Accounting

What Is Futa An Employer S Guide To Unemployment Tax Bench Accounting

Futa Suta Unemployment Tax Rates Procare Support

What S The Cost Of Unemployment Insurance To The Employer

Garrison Shops Had A Suta Tax Rate Of 3 7 The State S Taxable Limit Was 8 000 Of Each Employee S Brainly Com

2022 Federal State Payroll Tax Rates For Employers

Many Employers Face Higher State Unemployment Insurance Tax Costs Due To Covid 19

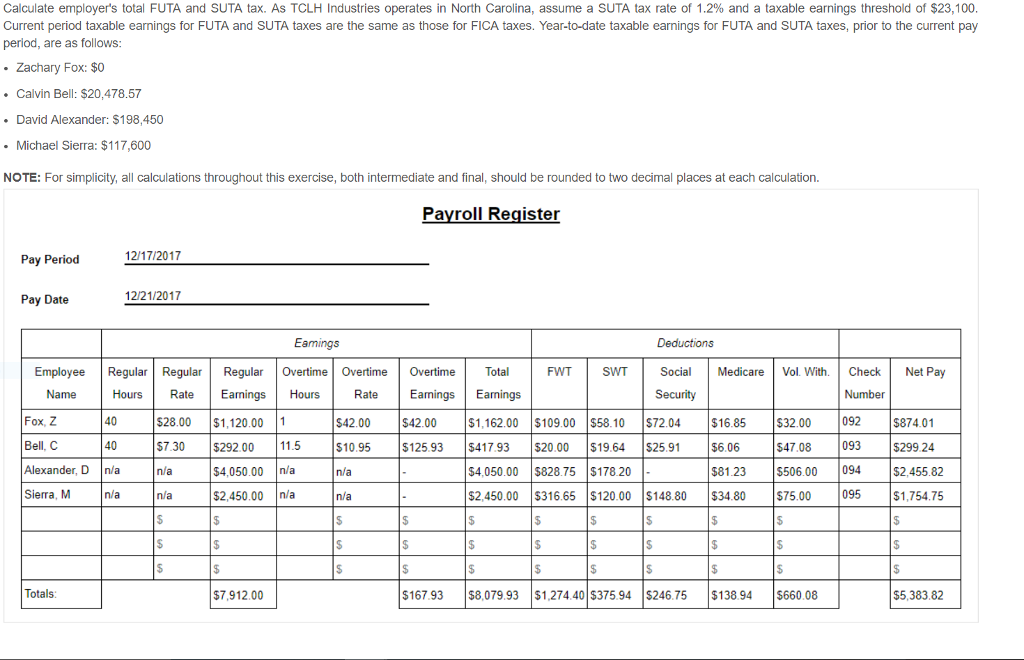

Calculate Employer S Total Futa And Suta Tax As Tclh Chegg Com

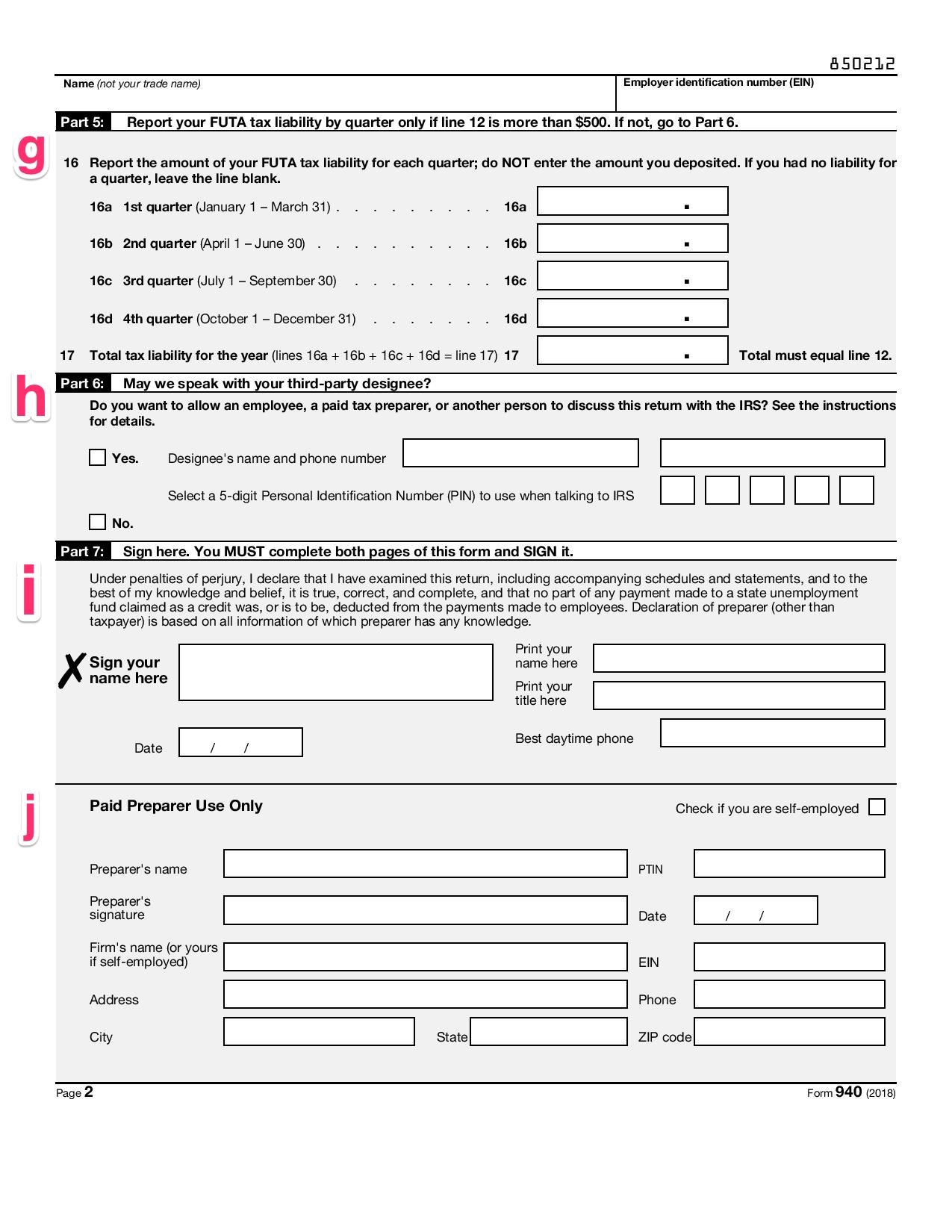

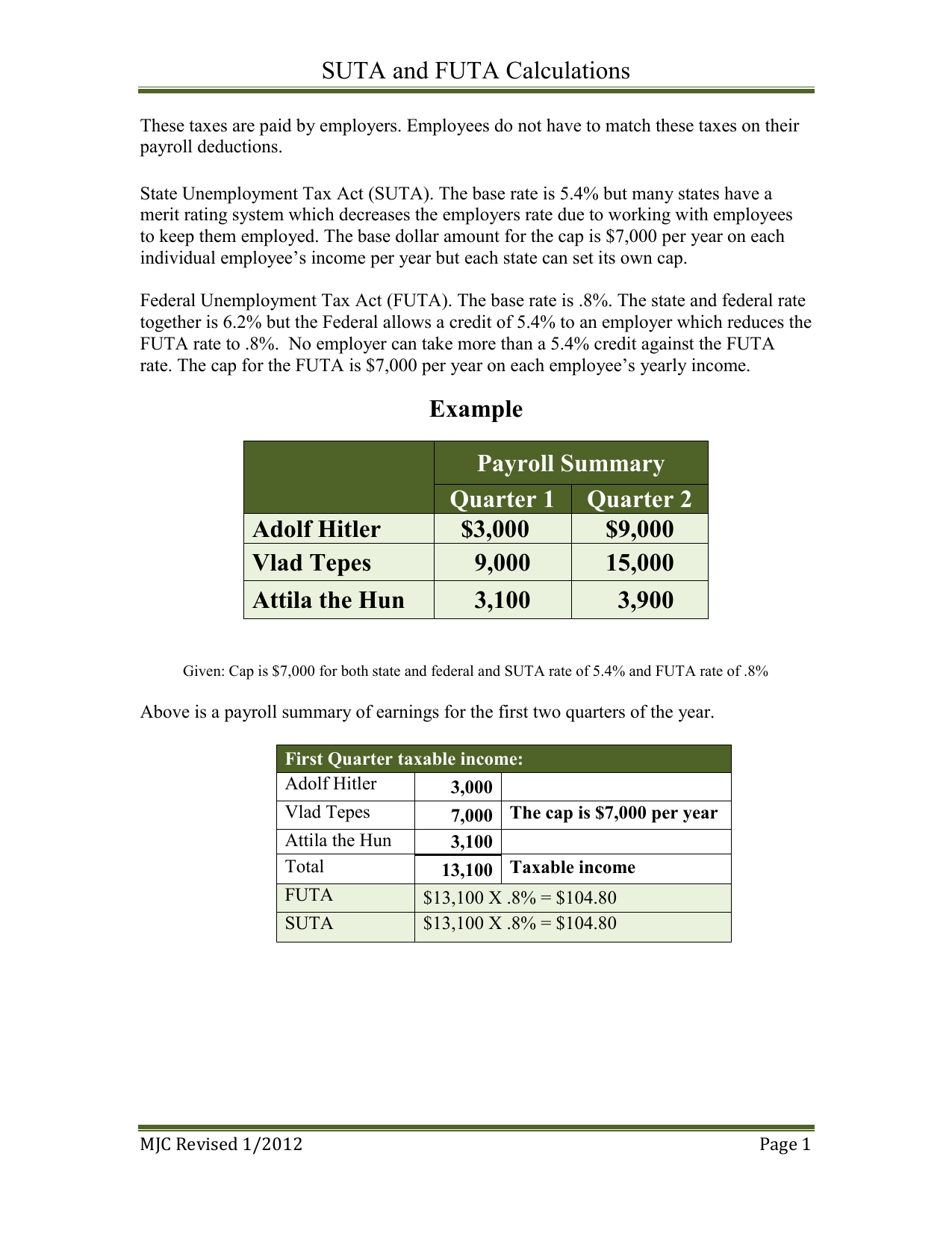

Systems Understanding Aid 9th Edition Suta And Futa Calculations

Oed Unemployment Ui Payroll Taxes

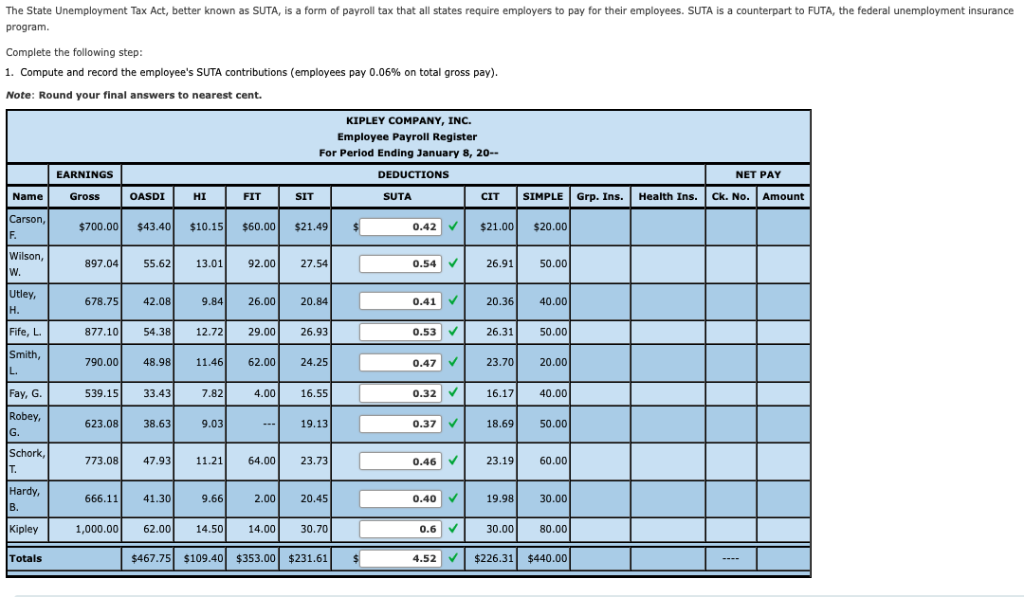

Solved The State Unemployment Tax Act Better Known As Suta Chegg Com

State Unemployment Tax Act Suta Tax Rates 123paystubs Youtube

Are Employers Responsible For Paying Unemployment Taxes

What Is The Futa Tax 2022 Tax Rates And Info Onpay

Futa Tax Overview How It Works How To Calculate

How To Reduce Your Clients Suta Tax Rate In 2014 Cpa Practice Advisor